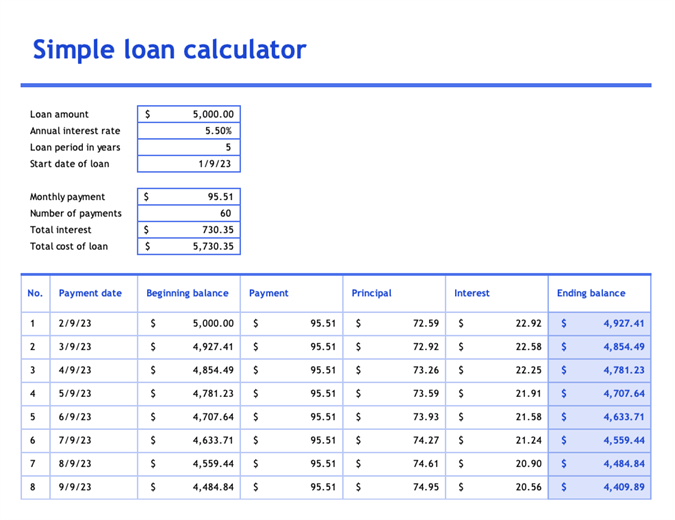

A loan amortization schedule template refers to a list of monthly or quarterly payments on account of principal amount and interest amount. It can further highlight the amount of insurance which is also deducted in installment amount to secure the outstanding loan amount. A mortgage loan amortization schedule refers to a monthly installment plan against the property which is provided by the borrower as security. This schedule reflects the outstanding balance of loan amount after paying the principal amount of the current period. Usually, a defined markup rate is charged on the remaining balance of the outstanding loan to calculate the interest amount. By looking at the schedule, valuable information regarding loans can be obtained. This information can be, like opening loan balance, rate of markup, principal, insurance and interest amount for current period and current outstanding loan amount.

Importance of Loan Amortization Schedule

A loan amortization schedule outlines the details and terms of the loan in a specialized manner. Certainly, this schedule works as a calculator that simply calculates different values based on the data that a user provided in the shape of a table. It generally provides details of each periodic payment, known as installments, made by a borrower based on this loan amortization schedule. A loan can only be amortized by making cash payments. Basically, a concise loan amortization schedule refers to the smart process of paying off a mortgage or consumer debt, most likely over time through regular payments that may be settled on a monthly or annual basis. Typically, a vital purpose of an amortization schedule is to define a system that can display the numbers of actual payments, monthly or quarterly payments, rate of interest, total principal, interest and insurance amount paid and remaining outstanding principal amount.

Details of Loan Amortization Schedule

Whenever someone borrows a loan from a bank, it would certainly be wise to analyze the amount of loan he/she is borrowing from the bank. A loan amortization schedule is a great way to determine whether you are getting funds at an economical markup rate or a costly rate. It further guides you to understand the total amount you will have to pay if you borrow a certain amount as a loan. You will find different software available online or offline which can calculate a loan amortization schedule. By using them, you can organize the amount of amortization in the form of a table or a chart. Perhaps you can prepare your own amortization schedule by using Microsoft Excel as well. The basic principal of preparing an amortization schedule is to keep track on the repayment procedure of a loan. Additionally, it will also clarify the exact amount of interest that applied on the principal amount of loan that you have to pay in the snippets.

Templates for Loan Amortization Schedule

omextemplates.content.office.net